Finding a starting point for user needs workshops can be difficult. For this week’s workshop for HMRC’s charities content we used data to structure the agenda.

Initially, fellow content designer, Kelly Arnstein, and I planned to move through the tasks charities need to complete to claim tax relief. We were going to start with applying for recognition as a charity for tax purposes and continue with the tax reliefs charities are entitled to.

But when we looked at the data it gave us a different perspective. We took HMRC’s webtrends data, data from HMRC contact centres, Google Analytics data on existing GOV.UK pages and the responses from a user research session with the National Council for Voluntary Organisations (NCVO). They pointed unanimously to the importance of Gift Aid to charities.

But when we looked at the data it gave us a different perspective. We took HMRC’s webtrends data, data from HMRC contact centres, Google Analytics data on existing GOV.UK pages and the responses from a user research session with the National Council for Voluntary Organisations (NCVO). They pointed unanimously to the importance of Gift Aid to charities.

We made Gift Aid our starting point. It helped us understand that what charities want from HMRC is not detailed descriptions of tax rules, but a clear path to making the most of the donations they receive.

Beyond Gift Aid we made more interesting data-derived discoveries about what charities are looking for. VAT was surprisingly popular and analysis showed that charities aren’t seeking to understand how to account for VAT but whether they’re exempt from paying VAT on purchases. Again, charities are looking for a quick answer about how they can make the most of their resources, in this case by minimising their expenditure.

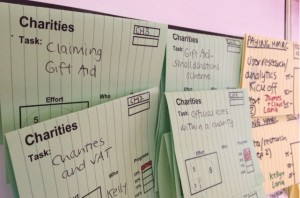

From this point we made a detailed list of topics in order of the number of visits to existing HMRC pages and used this as our agenda, moving from the most popular subjects to little-visited areas. The result was that at every point in the workshop we knew which was the most important topic area to consider next.

Our next step will be to create GOV.UK content based on these user needs. Supported by specialist information from HMRC we'll create a complete offering of guidance for charities on GOV.UK. We'll be posting further updates as we build the content.

Leave a comment