We met with the Tax Information Group (TIG) on 17 September to introduce them to our work on transition and show them some of our designs.

The TIG includes information professionals, tax lawyers and accountants from many of the major law firms and accountancy practices. Professionals working in these firms are using the specialist content published by HMRC every day in their work. Our thanks to Jo Vodden and Lissa Allcock for making the arrangements.

We are also meeting a similar group of Professional Support Lawyers in October. If you represent a group who may be interested in getting involved, please get in touch.

Iterating the manuals design

We received lots of useful feedback from the TIG on our first designs for the manuals. It was reassuring that we had many of the same comments we received at our session in August together with some new comments including:

- More work is needed on the date change function. Will this be ‘sticky’ as you navigate around the manual? Each page should also show a last updated date and (if an older version) the next updated date so users can see when the legislation changes

- Applying a taxonomy (something we are working on) would make the index more powerful so that you could browse by tax

- Can we have links to the legislation and when will legislation.gov.uk have the current amended versions of all legislation? Can links for case law take users to public case law databases such as BAILII?

- The search engine should deal with fuzzy matching, so that TMA 1970 and Taxes Management Act would both return results on any references to this act in the text

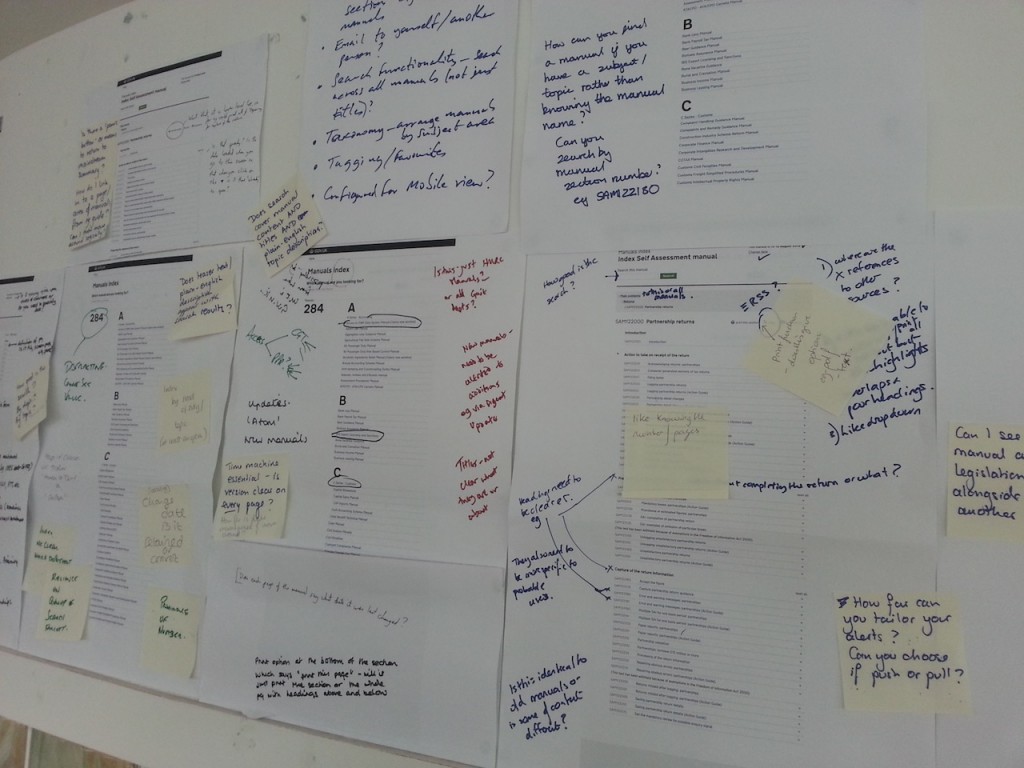

We will be taking all of this feedback and improving the design for future testing. Thanks again to everyone who has helped with this work. Your hard work is proudly displayed on one of our walls ready for some new designs to be produced:

Leave a comment