The HMRC manuals are HMRC's internal guidance for staff. HMRC publish these for taxpayers and their advisors in accordance with the Freedom of Information Act 2000.

There are around 300 manuals containing approximately 80,000 pages of content. They are often used by tax agents and tax advisers because they represent the HMRC view on many parts of complex tax law. Some text in the manuals is withheld from publication because of exemptions in the Freedom of Information Act.

Unlike much of the content that moves to GOV.UK, GDS won't be editing the manuals. These will move to GOV.UK and will be repurposed into a format that is easier to search, easier to browse, easier to view and easier to print.

As with all work at GDS, our starting point for identifying how we should transition the manuals to GOV.UK is to start with user needs.

Identifying user needs

There are many possible user needs for the manuals. One of the main user groups is tax agents and advisers.

Capturing user needs for this group was an easy start - before I joined GDS I was working in private practice as a solicitor and often used the HMRC manuals in my day job. So we started with my user needs when I was a tax lawyer:

I am a solicitor and I need to view a page of the manuals at a particular date in the past so that I can find the correct information I need to advise my client.

I also wanted to be able to:

- search a section of the manuals

- view more than one page of the manuals at once by expanding a whole section of the manual

- get email updates when a manual changes, or part of a manual changes

- click links to legislation through to legislation.gov.uk

- redline compare different (historical) versions of a manual

First designs

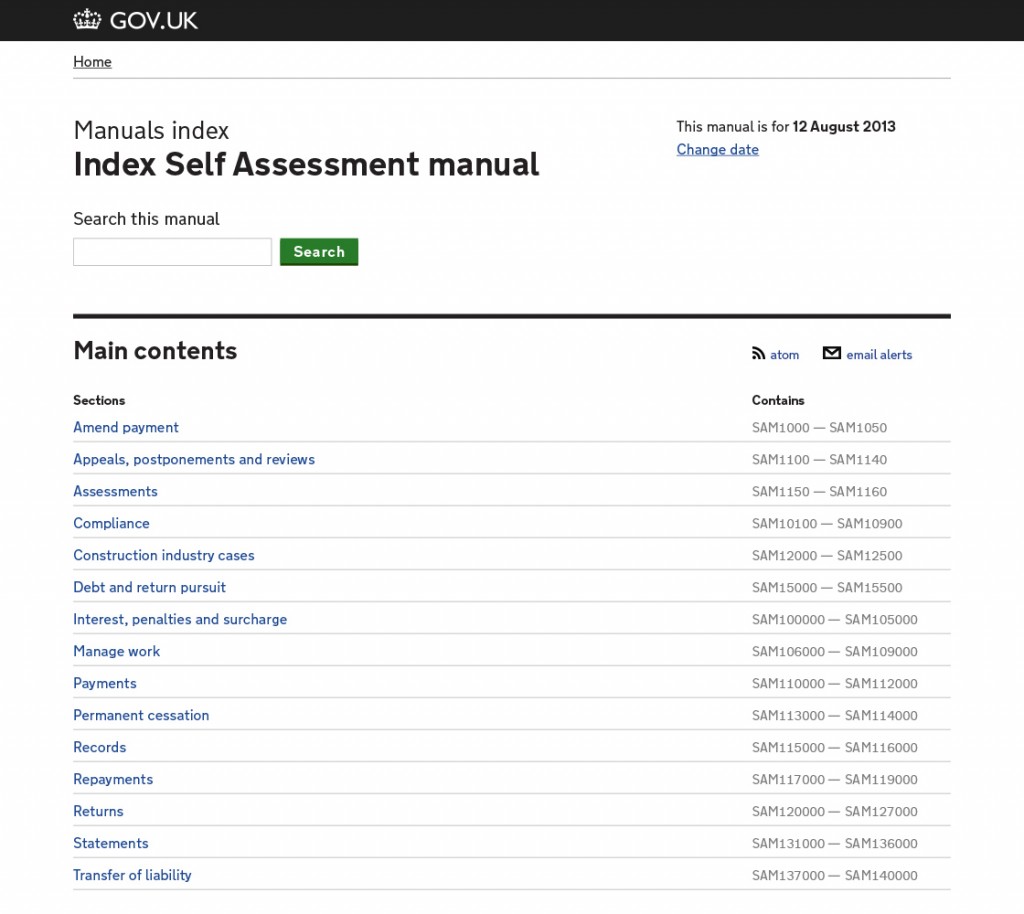

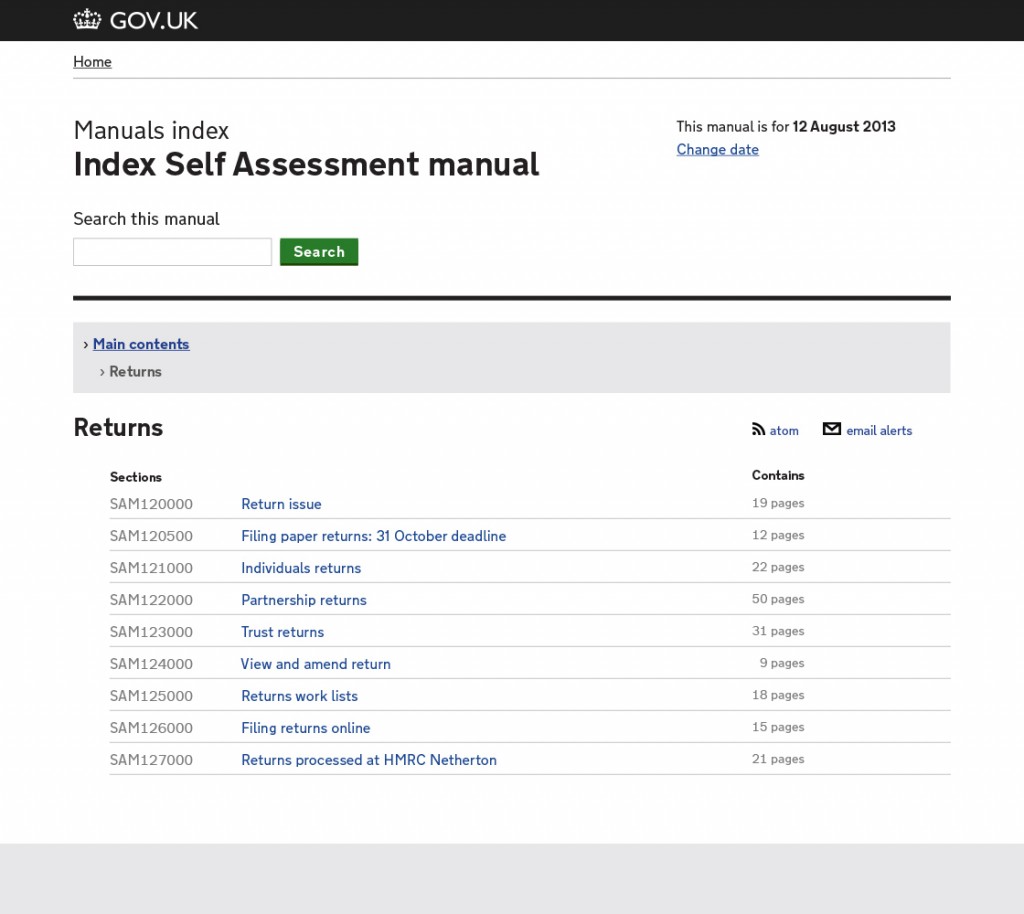

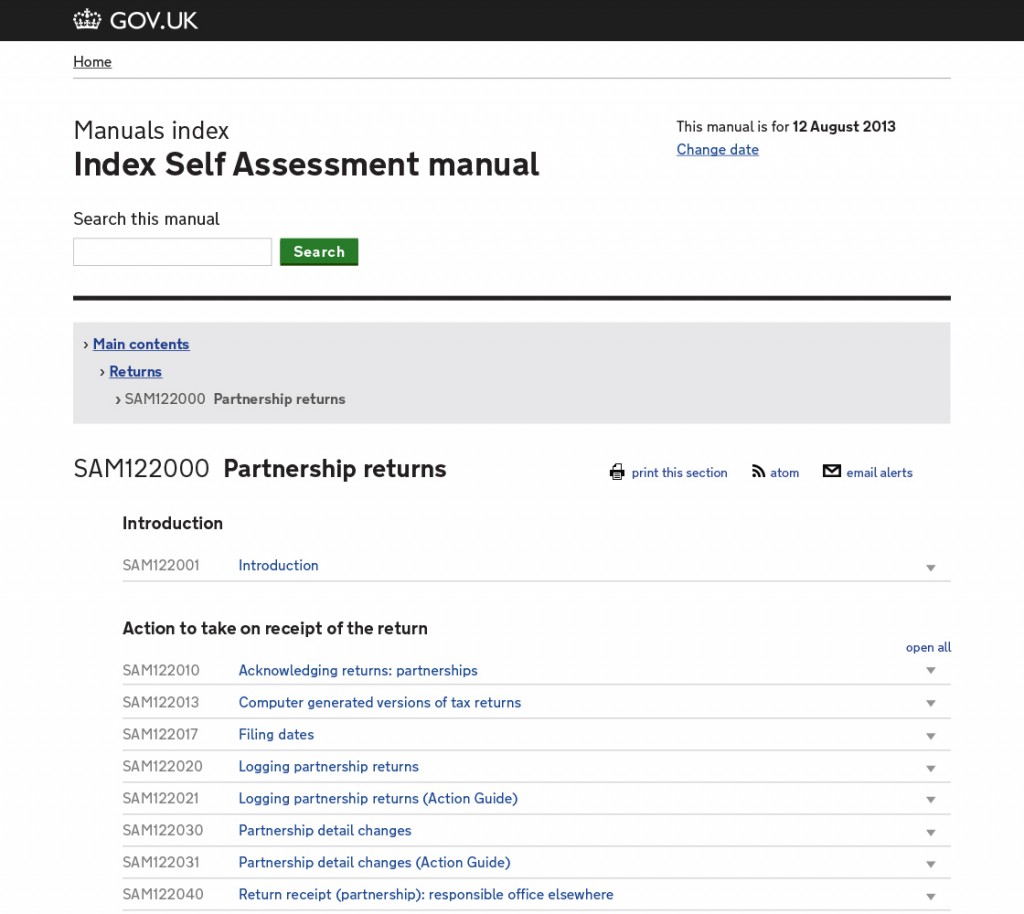

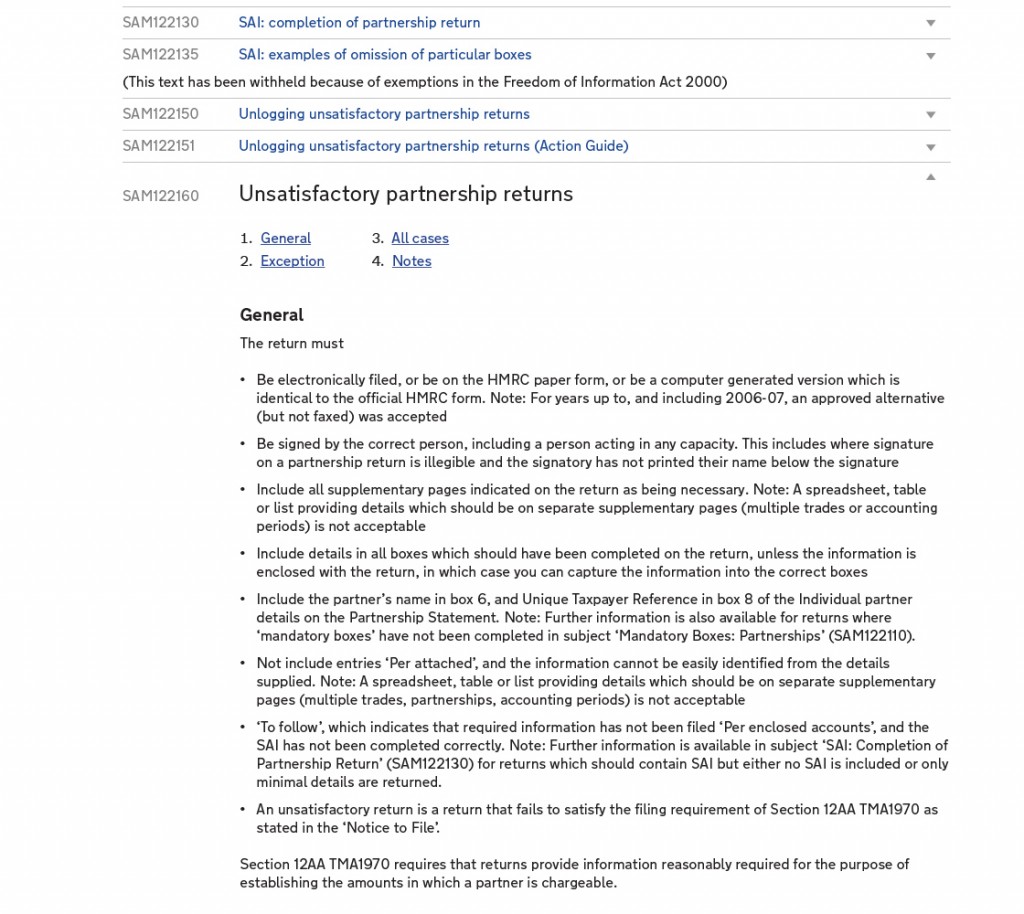

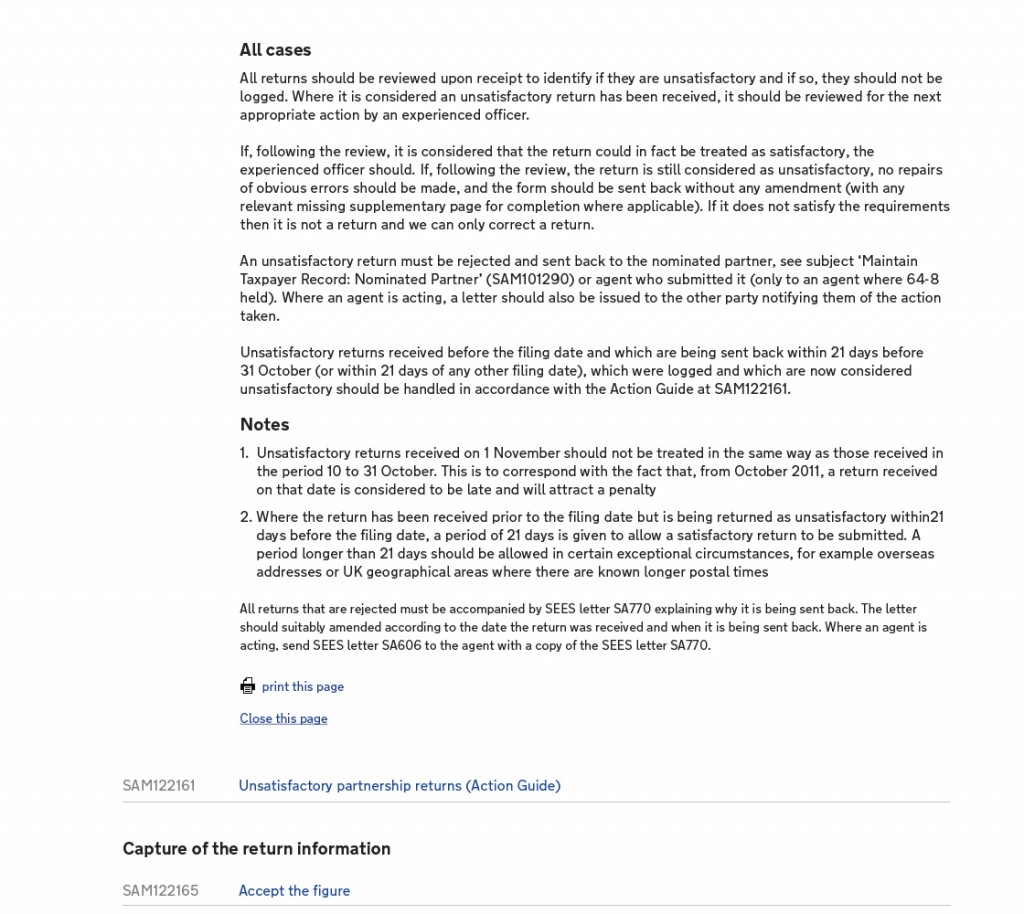

Stephen McCarthy, a GDS designer, used my user needs to create a first design of how the manuals might look when they move to GOV.UK, using example text from the Self Assessment manual:

On the top of the page there's an option to change the date to see the manual as it was at a particular date in time. This is similar to the functionality in the Trade Tariff on GOV.UK and the FCA Handbook.

Note the email alerts, atom feed links and print options for a whole manual or sections of the manuals.

User testing

We showed the manuals pages to the reps from the tax professional bodies when they visited GDS on 21 August. They gave us some very useful feedback that we will use to iterate and improve the designs:

Things users liked:

- the top level manual page has a logical layout with the correct number of pages

- the time machine functionality to see the manuals at a date in the past

- the ability to view multiple pages from the manuals in one view

- the option to print a clean version of the page

Things they didn't like:

- you can't tell what has changed in the manuals (we haven't designed the redlining functionality yet)

- the pages aren't clearly from HMRC

- the time machine button needs to be bigger and make it clearer when you aren't viewing the current version of the manuals

- there is no 'panic' button for non-technical users who may stumble across the manual and want to view less technical content (we are working on this idea as part of our work on planning user journeys)

- need more print/download options eg PDF or RTF download, print page range

We will be using this feedback to help develop our next round of designs.

We got further feedback on the manuals when we met with the Tax Information Group on 17 September.

Leave a comment